Quantifying the Federal Marketplace for Price To Win (PTW) Services (01-22-20)

As a long-time Price To Win (PTW) practitioner you may think that I would have been able to answer the following question that was posed by a colleague: What percentage of Federal competitive contract bidders routinely employ PTW as part of their capture processes? Hmmm. The answer is always going to be less than 100% but, these days, significantly more than 0%. But to add more clarity to the question let's frame the problem a little better.

[For those that are not too familiar with PTW here is a summary definition. First, the brutal fact of life chasing competitive opportunities is: ~5 bidders and 1 winner! PTW is the process that seeks to improve a bid team's probability of a win by defining the final, fully-gamed bid price they will require to bid to win an opportunity based upon: the identification and analysis of the competing bid teams; assessments of each bid team's ability to earn non-cost evaluation award points; and, the development of each competing bid team's most likely bid price and their respective ability to earn cost evaluation award points. Readers can get a more thorough description of the PTW process from my Amazon book entitled: Hope Is Not A Winning Strategy... But Price To Win Is.

As noted, an excellent PTW study provides a bid team with a rigorous competitor-based analysis that uses the qualitative and quantitative fruits of competitive analysis to provide a well-reasoned view of the overall competition. This is the proverbial "other hand with which to clap" the capture team's view of what price, all things considered, will be needed to win the opportunity. Without a PTW study a capture team is forced to listen to the sound of one hand clapping.

Can a PTW study improve the probability of a win for a bidder? Absolutely! Quantifying this, however, is not easy. On the one hand there is no doubt that performing a PTW study will cost more than not doing one. On the other hand, how can one correlate the value of improving win probabilities with the cost of doing so? Instead of wrestling with this issue I can point the reader to this fact: Over the past 20 years a preponderance of large businesses has adopted PTW as an essential part of their capture process. The incremental cost of doing this, apparently, is outweighed by the advantages that a rigorous PTW process brings to a capture effort.

My personal experience (I have led or participated in almost 2,500 PTW studies for companies of all sizes) is that a PTW study's recommendation is only one of the data points that are used to fashion a bid. A bidder can always underbid the PTW recommendation thus potentially winning and leaving money on the table or losing by showing the customer unrealistic pricing. Bidders can also at other times overbid PTW recommendations thus increasing the probability of a loss.

Unless the underlying PTW study is poorly executed it is inconceivable that the situational awareness, analysis and target price that such a study provides could fail to improve a bid team's understanding of what it will take to win. Knowing what it will take to win a competition rarely implies that the study sponsor can, or is able to, adopt the guidance provided by a PTW study. For this reason, it is prudent to start the PTW process and confront all competitive realities early and, unless a clear path to a win can be seen, be prepared to "lose early" and conserve resources. That is why some firms prefer the term Positioning To Win which entails doing whatever is needed to bring solution, team and price in line with PTW and other realities.]

It is a fact that the Federal government collectively buys more of every imaginable good and service than anyone else, anywhere on the planet. No company on earth supplies even a significant portion of the totality of what is bought. Of course, as you narrow down the range of goods and services, quasi-dominant and niche players come into focus. So, if we restrict our question to the IT goods and services marketplace, and to only prime bidders, we are looking at ~$50B a year that is being spent with large, medium and small IT contractors.

I am going to go out on a limb and suggest that the annual Federal IT goods and services marketplace competes/recompetes 5-year contracts as follows: 25 large opportunities (at $2.5B each), 250 medium opportunities (valued at ~$250M each), and 2,500 small opportunities (valued at ~$50M each). Since not each sized company bids every opportunity in an opportunity size(s) sweet spot, so let us say this: large companies, on average, bid for 15% of the large opportunities and 2.5% of the medium opportunities; medium sized companies bid for 2.5% of the Medium opportunities and .25% of the small opportunities; and, small companies bid for .01% of the medium and .005% of the small opportunities.

Let us further assume that the average cost of internal or external PTW studies supporting each of the various sizes of opportunity are: $75,000 for a large opportunity; $32,500 for a medium; and, $20,000 for a small. In addition, let us generalize that the average cost of pursuing an opportunity is 1.5% of the contract value for a large business, 1% for a medium-sized company, and .5% for a small company.

Further, let us posit that each of these opportunities has a 5-year term thus implying that each year the government lets contracts worth ~5 times what it spends in any particular contract year. Vying for this treasure trove of IT opportunity are: 50 large businesses (annual revenues >$2.5B); 250 medium-sized businesses (annual 5-year revenues of $250M); and, 2,500 small businesses (average size is $50M over 5 years).

95% of all contract opportunities have an incumbent contractor. This contractor may be performing well, adequately, or poorly. In the past, insurgent bidders used to prevail against incumbents ~25% of the time; today that percentage (due to improved CPAR documentation, LPTA, and other reasons) has risen to ~60%. It is unquestionable that being able to hang on to incumbent work is any contractor's highest and best use of pursuit resources, a bird in the hand being better than two in the bush. Losing an incumbency loses corporate muscle which makes the former incumbent weaker and the new incumbent stronger.

Like pizzas we can agree that companies and contracts (and task orders) come in three sizes: small, medium, and large. There is an order of magnitude more medium-sized companies and deal sizes than large ones. Moreover, there is at least an order of magnitude more small companies and deal sizes than there are medium-sized ones.

Small deals mostly attract the smaller bidders but often involve double-digit numbers of primes (we will assume 10 bidders on average). Small companies rarely have internal PTW capabilities and with limited budgets to spend on external services rarely engage external PTW services. Incumbent small businesses are probably the only relatively consistent PTW study commissioner in this category - we'll call their likelihood of performing a PTW ~2.5%.

Large deals usually involve small numbers of large company bidders (we will assume 3 bidders on average). Most large company players either have internal PTW capabilities or are used to contracting out to acquire external PTW support. PTW has become a key capture element for large businesses but, over the past 15 years large companies have vacillated between maintaining an internal PTW capability and acquiring external PTW support. The reason for this apparent indecision related to PTW, I'm sure, relates to budgetary issues, disappointing capture rates, and all manner of other change agents that buffet businesses.

That leaves us medium-sized opportunities. Here, one can be forgiven for thinking that this size category is the exclusive domain of medium-sized companies. The reality is, however, that this opportunity size category also attracts both large business bidders and, occasionally, small businesses, too. Thus, if we assume 5 bidders on average for this opportunity category, and further assume the mix of bidders typically includes 1 small business, 1 large business, and 3 medium-sized businesses. The probabilities for large and small businesses conducting a PTW study have already been stated. Medium businesses are a 50:50 proposition for performing a PTW study.

When we munge our assumptions we arrive at the following speculative answers including an answer to the original question: What percentage of Federal competitive contract bidders routinely employ PTW as part of their capture processes?

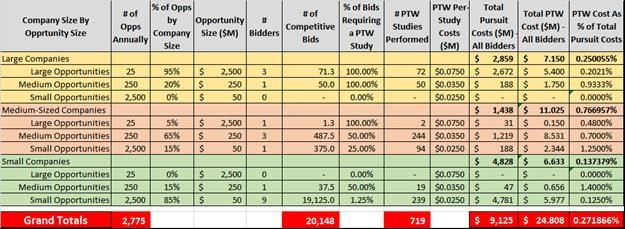

The table below presents an analysis of the foregoing information (percentages, guesses, and other estimates). As shown annual PTW costs, at our estimated levels of prevailing PTW study employment, for IT goods and services are ~.272% of overall annual Pursuit costs.

Another interesting finding is that, overall, there are approximately 9 bids for each opportunity and only 3.6% these bids employ PTW.

Good luck and happy hunting.

If your firm is grappling with how to develop an effective PTW-driven means of improving your firm's pWin's and overall winnability, please call me at (301) 807 8171. I am always happy to discuss how CAI/SISCo can help improve your firm's processes and win rates.

Copyright

© 2020 CAI/SISCo All Rights Reserved.

Site Design: Nutmeg Design • http://www.nutmegdesignstudio.com

Site Design: Nutmeg Design • http://www.nutmegdesignstudio.com